Real Estate Tax In Oregon . Surplus proceeds of property tax foreclosure sales. The estate owns the decedent's assets. property value appeals board. the oregon estate tax applies to both residents and nonresidents, but in diferent ways. However, specific tax rates can vary drastically. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. the effective property tax rate in oregon is 0.82%, while the u.s. If these assets generate income, it's subject to income tax. In both cases, however, the oregon. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. Average currently stands at 0.99%. 1 if you are estate planning in oregon and your estate is.

from www.pdffiller.com

the effective property tax rate in oregon is 0.82%, while the u.s. In both cases, however, the oregon. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. Average currently stands at 0.99%. 1 if you are estate planning in oregon and your estate is. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. the oregon estate tax applies to both residents and nonresidents, but in diferent ways. Surplus proceeds of property tax foreclosure sales. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. If these assets generate income, it's subject to income tax.

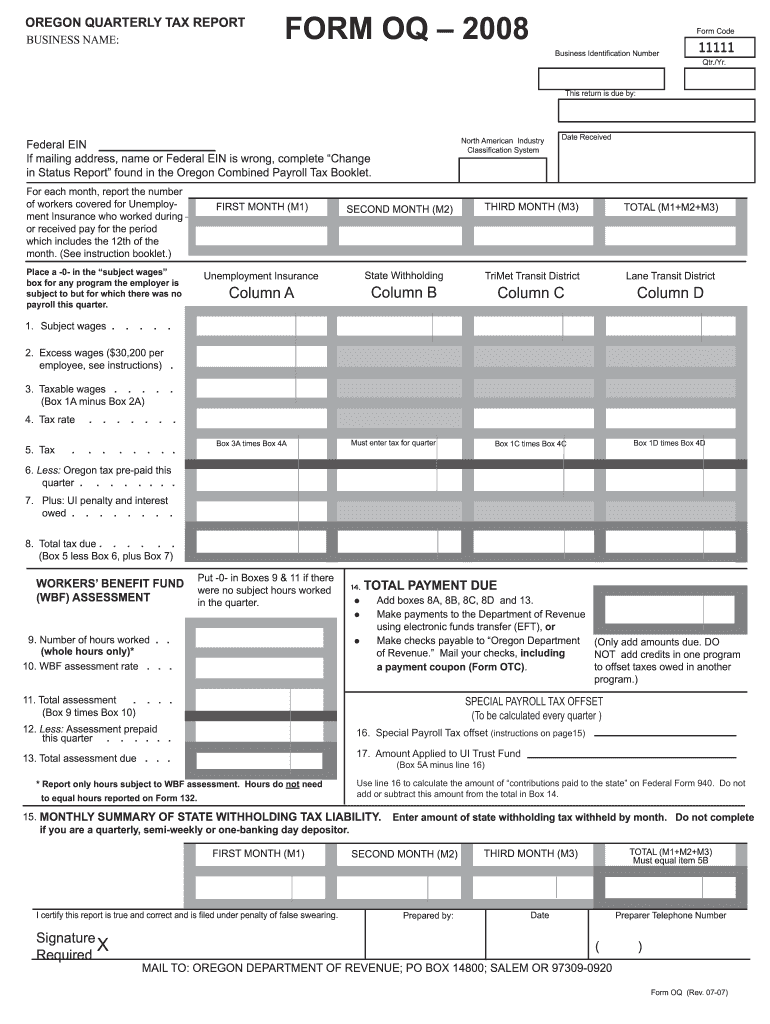

Oregon Form Oq Fill Online, Printable, Fillable, Blank pdfFiller

Real Estate Tax In Oregon Surplus proceeds of property tax foreclosure sales. If these assets generate income, it's subject to income tax. In both cases, however, the oregon. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. However, specific tax rates can vary drastically. the effective property tax rate in oregon is 0.82%, while the u.s. Average currently stands at 0.99%. The estate owns the decedent's assets. property value appeals board. 1 if you are estate planning in oregon and your estate is. Surplus proceeds of property tax foreclosure sales. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. the oregon estate tax applies to both residents and nonresidents, but in diferent ways. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and.

From info.courthousedirect.com

The 5 Most Common Real Estate Tax Credits Real Estate Tax In Oregon the effective property tax rate in oregon is 0.82%, while the u.s. If these assets generate income, it's subject to income tax. However, specific tax rates can vary drastically. The estate owns the decedent's assets. Surplus proceeds of property tax foreclosure sales. Average currently stands at 0.99%. we cover how oregon property tax rates are calculated, why some. Real Estate Tax In Oregon.

From www.youtube.com

Real Estate Tax Laws YouTube Real Estate Tax In Oregon the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. property value appeals board. In both cases, however, the oregon. However, specific tax rates can vary drastically. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. the effective. Real Estate Tax In Oregon.

From my-unit-property.netlify.app

Real Estate Property Tax By State Real Estate Tax In Oregon 1 if you are estate planning in oregon and your estate is. Surplus proceeds of property tax foreclosure sales. Average currently stands at 0.99%. If these assets generate income, it's subject to income tax. the oregon estate tax applies to both residents and nonresidents, but in diferent ways. the effective property tax rate in oregon is 0.82%, while. Real Estate Tax In Oregon.

From www.dochub.com

Commercial real estate contract Fill out & sign online DocHub Real Estate Tax In Oregon the oregon estate tax applies to both residents and nonresidents, but in diferent ways. In both cases, however, the oregon. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. If these assets generate income, it's subject to income tax. we cover how oregon property tax rates are. Real Estate Tax In Oregon.

From www.noradarealestate.com

How Often Are Real Estate Taxes Paid? Real Estate Tax In Oregon we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. property taxes rely on county assessment and taxation offices to value the property, calculate and. Real Estate Tax In Oregon.

From inmobimedia.com

La guía definitiva sobre los impuestos inmobiliarios de Oregón Real Estate Tax In Oregon the effective property tax rate in oregon is 0.82%, while the u.s. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. 1 if you are estate planning in oregon and your estate is. If these assets generate income, it's subject to income tax. In both cases, however, the. Real Estate Tax In Oregon.

From www.spadealawfirm.com

Am I Paying Too Much Real Estate Tax on my Delaware County Home Real Estate Tax In Oregon property value appeals board. In both cases, however, the oregon. 1 if you are estate planning in oregon and your estate is. Average currently stands at 0.99%. However, specific tax rates can vary drastically. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes.. Real Estate Tax In Oregon.

From slideplayer.com

Measure 84 Two New Tax Breaks for the Richest 2 Among Us. ppt download Real Estate Tax In Oregon In both cases, however, the oregon. the effective property tax rate in oregon is 0.82%, while the u.s. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. However, specific tax rates can vary drastically. the estate tax rate in oregon ranges from. Real Estate Tax In Oregon.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Real Estate Tax In Oregon we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. Average currently stands at 0.99%. 1 if you are estate planning in oregon and your estate is. property value appeals board. The estate owns the decedent's assets. property taxes rely on county assessment. Real Estate Tax In Oregon.

From www.pdffiller.com

Oregon Real Estate Forms Fill Online, Printable, Fillable, Blank Real Estate Tax In Oregon we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. In both cases, however, the oregon. property value appeals board. 1 if you are estate planning in oregon and your estate is. If these assets generate income, it's subject to income tax. Surplus proceeds. Real Estate Tax In Oregon.

From www.financestrategists.com

Real Estate Tax Strategies Definition, Tax Deductions, & Credits Real Estate Tax In Oregon In both cases, however, the oregon. property value appeals board. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. the oregon estate tax applies to both residents and. Real Estate Tax In Oregon.

From myemail.constantcontact.com

does your state impose high taxes? Real Estate Tax In Oregon we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. Average currently stands at 0.99%. 1 if you are estate planning in oregon and your estate is. Surplus proceeds of property tax foreclosure sales. the oregon estate tax applies to both residents and nonresidents,. Real Estate Tax In Oregon.

From yolandajoshua.gumroad.com

Top 5 Tax Deductions For Real Estate Investors Real Estate Tax In Oregon the effective property tax rate in oregon is 0.82%, while the u.s. The estate owns the decedent's assets. However, specific tax rates can vary drastically. If these assets generate income, it's subject to income tax. 1 if you are estate planning in oregon and your estate is. the oregon estate tax applies to both residents and nonresidents, but. Real Estate Tax In Oregon.

From legaltemplates.net

Free Oregon Quitclaim Deed Form PDF & Word Real Estate Tax In Oregon In both cases, however, the oregon. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. Surplus proceeds of property tax foreclosure sales. If these assets generate income, it's subject to. Real Estate Tax In Oregon.

From oaia.net

OREGON ASSOCIATION OF INDEPENDENT ACCOUNTS Real Estate Tax In Oregon If these assets generate income, it's subject to income tax. the oregon estate tax applies to both residents and nonresidents, but in diferent ways. The estate owns the decedent's assets. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. the effective property tax rate in oregon is 0.82%,. Real Estate Tax In Oregon.

From davegarcia.gumroad.com

Real Estate Taxes You Need to Know Real Estate Tax In Oregon If these assets generate income, it's subject to income tax. Average currently stands at 0.99%. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. we cover how oregon property tax rates are calculated, why some homes have higher tax bills, and which oregon counties have the highest taxes. The. Real Estate Tax In Oregon.

From moskowitzllp.com

10 Useful Real Estate Tax Credits for Developers and Investors Real Estate Tax In Oregon property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. the estate tax rate in oregon ranges from 10% to 16% and applies to estates above $1 million. In both cases, however, the oregon. Average currently stands at 0.99%. the effective property tax rate in oregon is 0.82%,. Real Estate Tax In Oregon.

From pdffiller.com

Oregon Real Estate Purchase Agreement Fill Online, Printable Real Estate Tax In Oregon the oregon estate tax applies to both residents and nonresidents, but in diferent ways. property taxes rely on county assessment and taxation offices to value the property, calculate and collect the tax, and. However, specific tax rates can vary drastically. If these assets generate income, it's subject to income tax. the estate tax rate in oregon ranges. Real Estate Tax In Oregon.